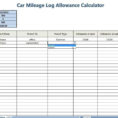

Do you need to make a self-employed expenses spreadsheet? Self-employed persons usually use these types of expenses for tax purposes. By making this type of expenses spreadsheet, you can easily calculate your tax liability. The expenses are actually quite simple to do and can be done without a lot of…

Tag: Self Employed Expenses Spreadsheet

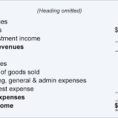

Self Employment Bookkeeping Sample Sheets

The Battle Over Self Employment Bookkeeping Sample Sheets and How to Win It Bookkeeping is the procedure of keeping full and up-to-date small business records. From time to time, it is a ton simpler to begin your QuickBooks bookkeeping over from the beginning and do it the proper way. Bookkeeping…