If you have made the commitment to bring a tracking sheet to help you stay on top of your budget, it is important to note that this does not mean you will have to have a spreadsheet. This is true for small business owners, budget planners, financial planners, budget directors,…

Tag: sample personal expenses spreadsheet

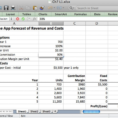

Sample Expenses Spreadsheet

A sample expenses spreadsheet will help you in understanding your financial situation better. It will make you able to plan and calculate the most appropriate budget. When you are working with a sample expenses spreadsheet, you will be able to make your figures more accurate and easy to understand. A…