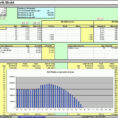

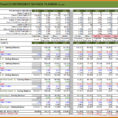

The spreadsheet has several worksheets. Simple spreadsheets will be the most often used form, and you’ve got to make most adjustments manually. The free spreadsheet is easily available for downloading here. Though most spreadsheets have the specific same format, when you consider performance, many distinct kinds of spreadsheets are normally…

Tag: retirement planning spreadsheet uk

Retirement Planning Spreadsheet

Many people in the business world today have learned that an appropriate retirement planning spreadsheet will make it much easier to find some of the most important numbers to consider in managing your retirement fund. Here are a few things to consider: Number One – The tax rate. With this…

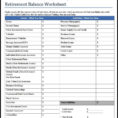

Retirement Planner Spreadsheet

There are many reasons why a retirement planner is necessary, and we’ll discuss a few here. With the right information and tips, you will be able to save money, protect your assets, and keep your business running smoothly. If you’re planning to use a plan, take advantage of these tips…