A lot of people use a retirement calculator spreadsheet template to prepare for their financial affairs after retirement. In most cases, they find that the spreadsheet templates that they are using have templates that need to be downloaded in order to work. This may seem like a small thing, but…

Tag: retirement calculator spreadsheet template

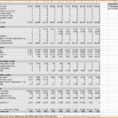

Retirement Calculator Spreadsheets

Retirement calculators are excellent for making a retirement plan with paper forms. However, they should not be the only tools used in a retirement planning method. We all know that saving money is important, and that if you save money it can make life easier later. Most people know that…