Retirement calculators are excellent for making a retirement plan with paper forms. However, they should not be the only tools used in a retirement planning method. We all know that saving money is important, and that if you save money it can make life easier later. Most people know that…

Tag: Retirement Calculator Excel Formula

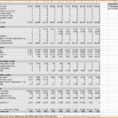

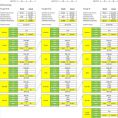

Retirement Calculator Spreadsheet

All About Retirement Calculator Spreadsheet Spreadsheets are somewhat more versatile than word processors when it comes to their capacity to manipulate massive quantities of rows and columns of information. The spreadsheet is going to do the rest for you. To put it differently, it’s a spreadsheet that can help you…