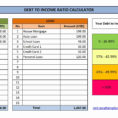

Keeping track of rental property expenses is a task that can be difficult and time consuming. However, there are certain steps that can be taken to streamline the process and ensure that you do not have to worry about these expenses on a regular basis. The first step that should…

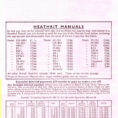

Tag: rental property income and expenses – excel spreadsheet

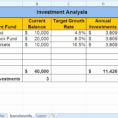

Excel Spreadsheet Income And Expenses

In order to make a decent living, you need to have a good Excel spreadsheet income and expenses. Here is the formula you need to use: Sheet A: Make sure that this sheet has a column called “Total.” There are a lot of different ways to do this. You can…

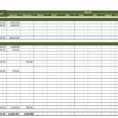

Rental Income And Expense Spreadsheet

Rental Income and Expense Spreadsheet are a great asset to know if you are interested in buying rental properties. It is very helpful to keep track of expenses. It helps you determine the financial capability of a property before you buy it. In today’s real estate market, luxury homes and…

Rental Property Excel Spreadsheet

It’s not that hard to use an Excel spreadsheet to make a rental property excel. However, you must keep in mind that there are a lot of mistakes that can be made when you try to use the free versions of this program. After all, it’s basically a spreadsheet, and…

Income And Expenses Excel Spreadsheet

Even though there are many alternatives to a standard income and expenditure spreadsheet, this document is still the most common type that companies use. This is because it is easy to use and you can get it done in less than 5 minutes. However, you may be wondering how to…

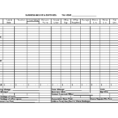

Rental Property Income And Expense Spreadsheet

Google provides a broad range of ad formats to match the most acceptable option with a site. A couple of decades back, Google began to put paid advertisements alongside the free search outcomes. Google is called a search engine for applicable information in the web. Google provides a nifty trick…

Rental Property Income Expense Spreadsheet

A couple of years back, Google began to put paid advertisements alongside the free search outcomes. Google is referred to as a search engine to get applicable information in the internet. Google provides a nifty trick in case you don’t understand the origin language. A couple years back, Google introduced…