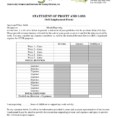

Profit and expense sheets are often a product of accounting. It is an overview of how an organization uses their assets, income, and expenses. The Profit and Expense sheet is used by a wide variety of organizations. From the business owner to the accounting firm to the CFO to the…

Tag: Profit And Loss Template For Small Business

Profit And Loss Statement Template

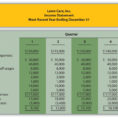

Sample Income Statement For Small Business

Sample Income Statement For Small Business

Profit And Loss Statement Template

Sample Income Statement For Small Business

Introducing Sample Income Statement for Small Business Consider spending twice as much time researching to ascertain your mission because investors wish to be sure your company is going to make them money. No matter in the event the company is dependent upon the men and women in charge, a well-planned…

Profit And Loss Statement Template

What You Don’t Know About Profit and Loss Statement Template Could Be Costing to More Than You Think Anyone can ready the statement although many small business owners opt for an accountant to make sure all financials are kept in order. 1 important consideration to remember about an income statement…