If you have made the commitment to bring a tracking sheet to help you stay on top of your budget, it is important to note that this does not mean you will have to have a spreadsheet. This is true for small business owners, budget planners, financial planners, budget directors,…

Tag: personal income expenses spreadsheet

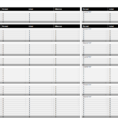

Income Expenses Spreadsheet

Are you sick of Excel spreadsheets and want to learn how to make your own income and expenses Excel spreadsheet? If so, then you are in the right place. We will discuss exactly how to do it. You must know that not everyone has the skills needed to design a…