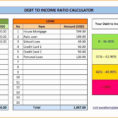

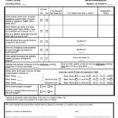

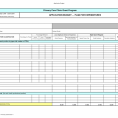

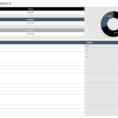

Personal finance spreadsheet is not a simple idea. Many think it should be one of the simplest things in the world to make, especially when you have your computer at hand. But they forget that personal finance sheet has two sides to it. The first side of this common personal…

Tag: Personal Finance Spreadsheet Template Uk

Personal Finance Spreadsheet Template

The Tried and True Method for Personal Finance Spreadsheet Template in Step by Step Detail A spreadsheet is truly only a calculator, but with far more flexibility. It can enhance your accuracy. There are lots of ways different men and women utilize budget spreadsheets. If figuring out how to earn…

Personal Finance Spreadsheet Template

Personal Finance Spreadsheet Templates

How to Use Personal Finance Spreadsheet Templates For Your Budgeting Needs Are you the type of person who has no problem making a budget, but you still need help with your personal finance spreadsheet templates? In the modern world, it is imperative that we all take time to understand the…

Personal Financial Spreadsheet Templates

Personal Financial Spreadsheet Templates – How To Choose There are quite a few options available for you to choose from when it comes to personal financial spreadsheet templates. While some are free, others require a fee. Therefore, while you are making your decision, it is always important to do your…

![Spread Sheet Templates ] | Excel Spreadsheet Templates Doliquid Inside Personal Financial Spreadsheet Templates Spread Sheet Templates ] | Excel Spreadsheet Templates Doliquid Inside Personal Financial Spreadsheet Templates]( https://db-excel.com/wp-content/uploads/2018/10/spread-sheet-templates-excel-spreadsheet-templates-doliquid-inside-personal-financial-spreadsheet-templates-118x118.jpg)