Do you know how to use a personal expense tracker spreadsheet? There are many benefits for doing so. When you are able to see where your money is going every single month, you will be better equipped to make sound financial decisions. A major decision in your life is which…

Tag: Personal Expense Tracker Spreadsheet

Business Expenses Template

Business Expenses Template

Business Expenses Template

Business Expenses Template

Business Expenses Template Ideas The One Thing to Do for Business Expenses Template To be considered a sensible expense, the item must be appropriate to your enterprise and used in an effort to earn money. The very last thing you wish to do is to run your company at a…

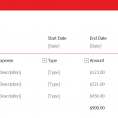

Expense Tracker Spreadsheet

What Is an Expense Tracker Spreadsheet? We all use expense tracking software in one form or another. Software that gathers expense data and delivers it in a convenient format is called an expense tracker spreadsheet. An expense tracker spreadsheet is extremely useful for tracking personal expenses. In order to track…