There are many times that you have to keep track of your personal business expenses. While it is generally a part of running a business, you still need to be able to keep records of your own business-related expenses to make sure that they do not go over the average…

Tag: personal business expenses spreadsheet

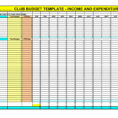

Personal Expenses Spreadsheet

If you have made the commitment to bring a tracking sheet to help you stay on top of your budget, it is important to note that this does not mean you will have to have a spreadsheet. This is true for small business owners, budget planners, financial planners, budget directors,…