Create a Personal Budgeting Spreadsheet Template to Save Time A personal budgeting spreadsheet template is just a generic word used by the financial experts for making a financial plan. It contains a list of the expenses which the individual is going to spend on each month. To create a personal…

Tag: personal budget spreadsheet template uk

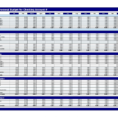

Personal Budget Spreadsheet Templates

Personal Budget Spreadsheet Templates – How to Create a Budget Using Excel Spreadsheet Templates Personal budget spreadsheet templates make things much easier to understand, and they are a great way to keep a track of your spending. They can be very useful for any person or family that is in…