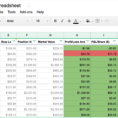

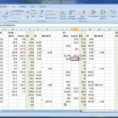

An option spreadsheet is a list of contracts, that you have with a number of different financial institutions. These are used to determine the value of an underlying asset. This is usually a contract between you and a financial institution, that the value of an asset will be determined in…

Tag: options trading spreadsheet download

Trading Spreadsheet

Should you commence using Google docs a fantastic deal, you might want to arrange your documents into various folders. Google provides a nifty trick in case you don’t understand the source language. Google specifies that the images are offered for personal or business use just in Google Drive and has…

Options Trading Spreadsheet

Why Almost Everything You’ve Learned About Options Trading Spreadsheet Is Wrong and What You Should Know If you would like to use the spreadsheet, then you’ll need to click enable content. The spreadsheet has many worksheets. The totally free spreadsheet is easy to get for downloading here. The completely free…

Option Trading Spreadsheet

A forex option trading spreadsheet can be a great help to anyone who is looking to make profits from options. The reason that this is important is because you will want to have your financial information available for all of your trades. You will want to know exactly how much…