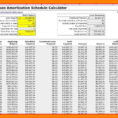

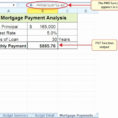

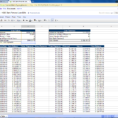

It is simple to create a mortgage spreadsheet and use it as a tool for business owners. If you already have a mortgage document you want to keep track of for your company, then create a spreadsheet with this format. Here are the basics on how to use this type…

Tag: mortgage spreadsheet with extra payments

Mortgage Spreadsheet With Extra Payments

The purpose of the mortgage spreadsheet with extra payments is to quickly and easily manage your mortgage payments. As the name suggests, it has extra payments added to it for ease of payment. This allows you to be able to make quick decisions when paying off your mortgage quicker. The…