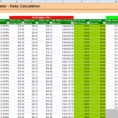

Excel, among the Office applications, is still the 800-pound gorilla in spreadsheets. It is possible to name your spreadsheet whatever you desire. Once you’ve printed your spreadsheet, make a new chart or edit existing one and see the next step, which provides you the ability to upload your CSV file….

Tag: mortgage repayment calculator excel spreadsheet

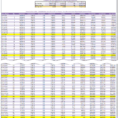

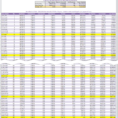

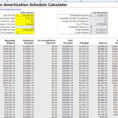

Mortgage Payment Calculator Spreadsheet

Click “Download” to choose the template that you need to use. Developing a contract template is a true time-saver when it has to do with making new contracts for various clients that all use the exact same clauses. Templates may also be helpful as soon as you’re attempting to lose…

Mortgage Repayment Spreadsheet

Mortgage repayment spreadsheet has been around for quite some time but just recently has really become popular. This is because a lot of people are finding that they can benefit from this type of software. They don’t have to hire a mortgage professional to help them, which saves them money….