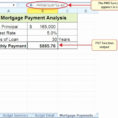

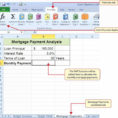

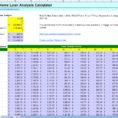

While many of us are aware of the mortgage refinance comparison spreadsheet that is now available on the Internet, many of us are less familiar with how it is to actually use this spreadsheet. The first thing you must understand is that the mortgage refinance comparison spreadsheet is a very…

Tag: mortgage refinance comparison spreadsheet

Mortgage Comparison Spreadsheet

A mortgage comparison spreadsheet can help you find the best mortgage options for your circumstances. This is a useful tool because it helps you to view the loan terms for your property, but also a useful tool because it allows you to compare the loan rates available. Mortgage comparison sheets…