Using a mortgage rate comparison spreadsheet will help you see what rate you can expect your loan to be for your new home. The first step is to make sure that you are able to do this, and then to find the spreadsheet that will suit you best. Once you…

Tag: mortgage rate comparison spreadsheet

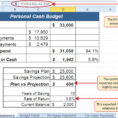

Mortgage Comparison Spreadsheet

A mortgage comparison spreadsheet can help you find the best mortgage options for your circumstances. This is a useful tool because it helps you to view the loan terms for your property, but also a useful tool because it allows you to compare the loan rates available. Mortgage comparison sheets…