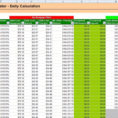

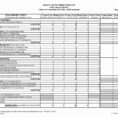

A loan comparison spreadsheet is an electronic spreadsheet that can be used to compare the different features of loans from different lenders. This is a great way to make sure you are getting the best rate on your new car loan or home mortgage loan and to avoid paying more…

Tag: mortgage loan comparison spreadsheet

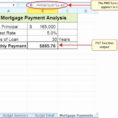

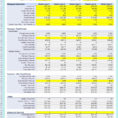

Mortgage Loan Spreadsheet

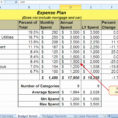

A mortgage loan spreadsheet is a spreadsheet that helps you manage your mortgage loan as well as all the other related mortgage loans and personal debt. You may be tempted to invest in software programs that can help you with your mortgage. However, as we are already aware, mortgage software…

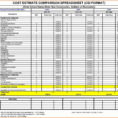

Mortgage Comparison Spreadsheet

A mortgage comparison spreadsheet can help you find the best mortgage options for your circumstances. This is a useful tool because it helps you to view the loan terms for your property, but also a useful tool because it allows you to compare the loan rates available. Mortgage comparison sheets…