For those of you who own a home or for those of you who want to get into the mortgage business, it is important to know how to use a mortgage lender comparison spreadsheet. When you have your mortgage broker up front, you will see his advertisements about their low…

Tag: mortgage lender comparison spreadsheet

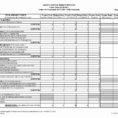

Mortgage Comparison Spreadsheet

A mortgage comparison spreadsheet can help you find the best mortgage options for your circumstances. This is a useful tool because it helps you to view the loan terms for your property, but also a useful tool because it allows you to compare the loan rates available. Mortgage comparison sheets…