Click on “Download” to pick the template you need to use. Developing a contract template is a true time-saver when it has to do with making new contracts for various customers that all use the specific same instructions. The template is only a starting point. You will see that a…

Tag: mortgage cost comparison spreadsheet

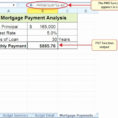

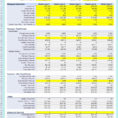

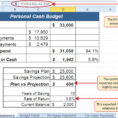

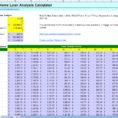

Mortgage Comparison Spreadsheet

A mortgage comparison spreadsheet can help you find the best mortgage options for your circumstances. This is a useful tool because it helps you to view the loan terms for your property, but also a useful tool because it allows you to compare the loan rates available. Mortgage comparison sheets…