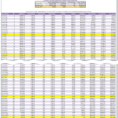

A mortgage payment spreadsheet is a tool that is useful for homeowners and home owners to keep track of their mortgage payments. It allows you to have a visual reminder of the amount of money you owe, with all of your monthly installments broken down and displayed in a neat…

Tag: Mortgage Amortization Spreadsheet Excel

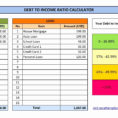

Mortgage Loan Spreadsheet

A mortgage loan spreadsheet is a spreadsheet that helps you manage your mortgage loan as well as all the other related mortgage loans and personal debt. You may be tempted to invest in software programs that can help you with your mortgage. However, as we are already aware, mortgage software…

Mortgage Amortization Spreadsheet Excel

A mortgage amortization spreadsheet can be a great aid to any professional who is managing your finances. It can be helpful in getting an understanding of what is going on with your finances and help you create a budget. Using this type of spreadsheet you can not only see the…