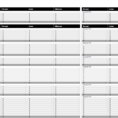

It is absolutely important to keep a personal income and expenses spreadsheet. It’s a fact that you don’t know what is going on around you, but at least you have some sort of record to go by. Since so many people are currently suffering from the economic recession, it’s a…

Tag: monthly personal income and expense spreadsheet

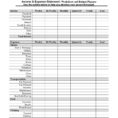

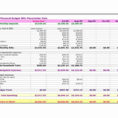

Monthly Income And Expense Spreadsheet

Excel, among the Office applications, is still the 800-pound gorilla in spreadsheets. It is possible to name your spreadsheet everything you desire. As soon as you’ve printed your spreadsheet, make a new chart or edit existing one and see the next step, which gives you the ability to upload your…

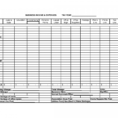

Monthly Income And Expenditure Spreadsheet

Some documents take a lengthy time to download but that is dependent on your link. Do more, together with Google Docs, everyone is able to work collectively in the exact same document at precisely the same time. A rising number of people utilize PDF documents to discuss their ideas over…

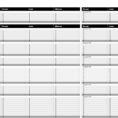

Monthly Personal Expenses Spreadsheet

Many people rely on a monthly personal expenses spreadsheet to keep track of what they are spending money on. If you have ever been in this situation then you know how hard it can be to actually maintain a good habit with spending. The first step to making a personal…