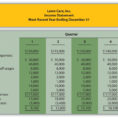

Profit and expense sheets are often a product of accounting. It is an overview of how an organization uses their assets, income, and expenses. The Profit and Expense sheet is used by a wide variety of organizations. From the business owner to the accounting firm to the CFO to the…

Tag: Monthly Income And Expense Template

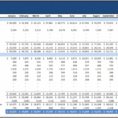

Personal Monthly Cash Flow Statement Template Excel

Personal Monthly Cash Flow Statement Template Excel – Is it a Scam? There are a variety of ways to earn money by investing in real estate. At this point you apply all that money every month to the loan payment. It’s never been simpler to invest modest amounts in the…