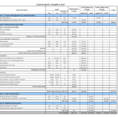

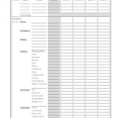

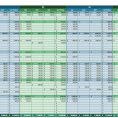

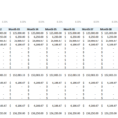

Budget forms are used by many businesses to ensure that the income received from an employee is used for the business’s profits. Some businesses hire a freelance worker to fill out these forms. The freelancer does the work and receives the payment as compensation. A freelancer that fills out a…

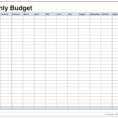

Tag: Monthly Budget Spreadsheet

Monthly Budget Spreadsheet

The Pitfall of Monthly Budget Spreadsheet When you get prepared to budget, don’t forget to be honest. If you are feeling the budget is good, then find methods to quit spending in the area which you went over. Fortunately, it doesn’t need to be that way and it is possible…