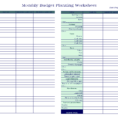

Monthly Budget Planner Worksheet in a learning medium can be utilized to test pupils qualities and knowledge by answering questions. Since in the Student Worksheet about 90% of the articles of the complete book are questions, equally multiple decision and answer questions that aren't available. While the remainder is made up of brief overview of the niche matter. Applying worksheet, teachers no more have to bother to gather issues or questions. With the press the instructor is just required to target on providing a maximum comprehension of the given subject. For the evaluation and check of studying outcomes, the teacher only wants to see and direct the issues previously available in the worksheet. Since more or less the worksheet functions as helpful tips for students in carrying out education responsibilities both individually and in groups.

Tag: Monthly Budget Planner Spreadsheet

Monthly Budget Planner Spreadsheet

A monthly budget planner spreadsheet is simply a spreadsheet that allows you to have a monthly budget. It is a great tool for planners who don't have the time to shop, but need a way to track their spending.

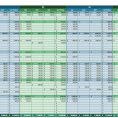

Monthly Budget Spreadsheet

The Pitfall of Monthly Budget Spreadsheet

When you get prepared to budget, don't forget to be honest. If you are feeling the budget is good, then find methods to quit spending in the area which you went over. Fortunately, it doesn't need to be that way and it is possible to budget for your leisure and fun expenses also.

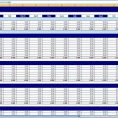

Monthly Budget Spreadsheet Template

Find Out Who's Talking About Monthly Budget Spreadsheet Template and Why You Should Be Concerned

The template can be found in PDF format. The completely free spreadsheet template can help you make a record of expected expenses for the full month against their earnings. In others word, you may use our absolutely free budget spreadsheet template in excel to keep track of your earnings and expenses employing a mutual set of budget categories. When you make a monthly budget planning spreadsheet Excel template you will not simply keep an eye on your money, but also find out where you're falling short.