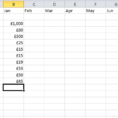

Managing bills is quite easy when you have a spreadsheet free service. You just have to spend a little time figuring out how to make your expenses and income on a daily basis and then you will have all your bills from this day in order so that you will…

Tag: manage my bills free spreadsheet

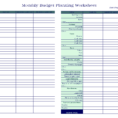

Manage My Bills Free Spreadsheet

Should you commence using Google docs a fantastic deal, you might want to arrange your documents into various folders. Google provides a nifty trick in case you don’t know the origin language. Google specifies that the graphics are offered for personal or business use just in Google Drive and must…

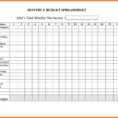

Manage My Bills Spreadsheet

How to Manage My Bills From Your Own Phone Most people never realize that they could have a way to manage my bills if they did some very simple things. If you want to find out how to do it, go ahead and continue reading. One of the easiest ways…