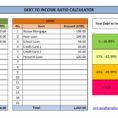

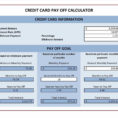

A loan payment calculator spreadsheet can be the easiest way to budget for your next payday loan. It will help you make better financial decisions, reduce your stress and save you time. With the economy the way it is, more people are taking out payday loans in order to get…

Tag: loan repayment calculator spreadsheet

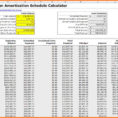

Loan Calculator Spreadsheet

Excel, among the Office applications, is still the 800-pound gorilla in spreadsheets. It is possible to name your spreadsheet whatever you want. Once you’ve published your spreadsheet, make a new chart or edit existing one and see the next step, which gives you the capability to upload your CSV file….