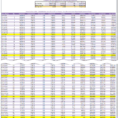

Tag: Loan Amortization Schedule Excel Download

Loan Amortization Spreadsheet

Rumored Buzz on Loan Amortization Spreadsheet Discovered By the close of the month, you will observe your loan was reduced and you’ve saved your money. The loan has to be fully repaid by the conclusion of the expression. Personal loans can be useful in a lot of scenarios. Amortized loans…

Mortgage Spreadsheet Template

Top Mortgage Spreadsheet Template Choices Mortgage loans are among the most often encountered cases that have moved Excel spreadsheets into a more personal field. You are able to take loans against your current property or take a normal home loan. Hard money loans are less difficult to get because they…