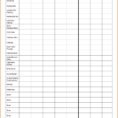

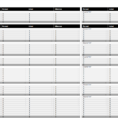

Expenses spreadsheet excel. This is one of the best proven ways to track expenses. There are other ways of tracking expenses and they may work, but they are not as efficient and effective as this program. The question that keeps coming up every month is ‘how am I going to…

Tag: living expenses spreadsheet excel

Living Expenses Spreadsheet

To get a good handle on how much money you are spending on your living expenses, you need to make a living expenses spreadsheet. You will need to be creative and easy to understand to make this work. What most people don’t realize is that they spend more on large…