Click “Download” to choose the template that you want to use. Developing a contract template is a true time-saver when it’s to do with creating new contracts for various customers that all use the specific same instructions. Templates may also be helpful as soon as you’re attempting to lose or…

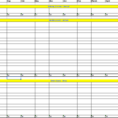

Tag: Itemized Deductions Spreadsheet

Spreadsheet For Tax Expenses

There are two main types of taxes: income taxes and sales taxes. Although most people tend to use the term sales tax to describe the concept of a personal income tax, there is another type of tax that is entirely separate from these two and is referred to as the…