In the event you want to earn your record more protected, you may also convert excel to PDF to prevent the misuse of the data in the dictionary. You may also import your present documents to Google Docs. Google Records has a Spreadsheet feature which also enables you to earn…

Tag: investment property expenses spreadsheet

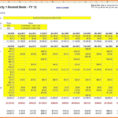

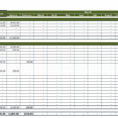

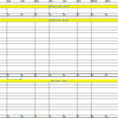

Property Expenses Spreadsheet

A property expenses spreadsheet is something that every owner of real estate should have. It will give you insight into what you can and cannot spend on your own home. There are several advantages to using a property expenses spreadsheet. They will help you determine the amount of equity that…