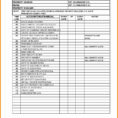

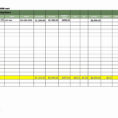

Using a property comparison spreadsheet is the ideal way to get started. It will help you understand exactly how much you can afford to pay for your next home. Here are some of the main advantages of using a spreadsheet to help you budget your finances. This could save you…

Tag: investment property comparison spreadsheet

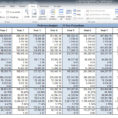

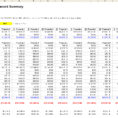

Investment Property Spreadsheet

In my investment report, I discuss how to create an investment projection spreadsheet. Here, I will discuss what makes an investment projection spreadsheet work and how you can develop one on your own, with a great deal of success. The first thing to know is that there are three types…