Property investment analysis is an important tool for all investors to have on hand. Whether you are interested in real estate or a different type of investment, you need to understand the critical features that separate the good ones from the bad ones. In a nutshell, the basic property investment…

Tag: investment property cash flow analysis spreadsheet

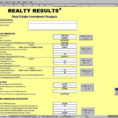

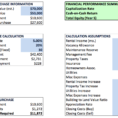

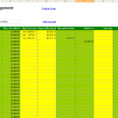

Investment Property Analysis Spreadsheet

Investment Property Analysis Spreadsheet The investment property analysis spreadsheet can help you find out all of the details about a property that you are interested in buying. As soon as you have bought it, the next thing you need to do is ensure that it is in an area that…