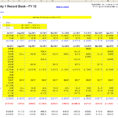

The investment property calculator spreadsheet is a powerful software program that allows real estate investors to check and monitor their investment. It calculates the most critical factors, such as housing values, rental values, property taxes, mortgage costs, taxes, and the cash flow of the real estate transaction. The investment property…

Tag: investment property calculator excel spreadsheet nz

Investment Property Calculator Spreadsheet

There are several reasons why a financial planner might recommend an investment calculator spreadsheet. They allow you to quickly assess your investments and see if you are paying too much or too little in fees. You can also easily enter your own financial information, so you can create a customized…

Investment Property Calculator Excel Spreadsheet

A Property Investment Calculator That Can Help You Make Money In The Long Run Investing in property is a risky business. The first few months are the most profitable, but this depends on how well you plan and budget your time and money. The ideal result of investing in property…