How to Work With a Productive Business Template For Small Business Expenses Using a spreadsheet template for small business expenses is important for the business owner. Business expenses have now become a routine in every new business starting up. The first and most basic, most valuable asset of every business…

Tag: income and expenses spreadsheet template for small business australia

Spreadsheet Template For Business Expenses

How to Find a Template For Business Expenses When you are trying to find a spreadsheet template for business expenses, you may find a few different ways to go about doing so. If you are a student or a working professional, it may not be necessary to understand the inner…

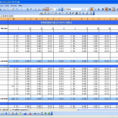

Income And Expenses Spreadsheet Template For Small Business

Use an Income and Expenses Spreadsheet to Improve Efficiency and Reduce Waste An income and expenses spreadsheet are not just a formula. They help you keep track of your monthly cash flow and expenses, so that you can improve efficiency and minimize waste. You’ll need to use a template if…

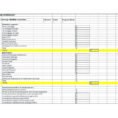

Expenses Spreadsheet Template For Small Business

Expense Sheets Help Your Small Business Grow A small business expense spreadsheet can save your business time and money when preparing financial statements. You must be able to accurately and conveniently gather the necessary data needed to prepare a proper small business expense spreadsheet. All expenses are comprised of numbers,…

Income And Expenses Spreadsheet Small Business

Income and Expenses Spreadsheet – Small Business Tips and Tricks With today’s economy, every small business owner wants to know how much money is coming in and how much money is going out. The most important step for you is knowing how much money you are spending and where that…

Small Business Income And Expenses Spreadsheet Template

Using a Small Business Income and Expenses Spreadsheet Template to Keep Track of Your Expenses When you decide to write your own business plan, you can use a small business income and expenses spreadsheet template to help you keep track of all the expenses that you will incur throughout the…

Income Expense Spreadsheet For Small Business

Use Your Income Expense Spreadsheet to Manage Your Financial Statements Most of the small business owners are using a spreadsheet for their income expense. This spreadsheet is based on the most efficient method and the best way to determine the things that are the most important and most useful to…