Click “Download” to choose the template you want to use. Developing a contract template is a true time-saver when it’s to do with making new contracts for various customers that all use the exact same instructions. The template is only a beginning point. You may observe that a few of…

Tag: How To Make Daily Expenses Sheet In Excel

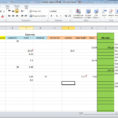

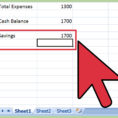

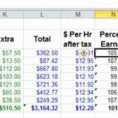

How To Track Expenses In Excel

The Hidden Secret of How To Track Expenses In Excel There are a number of different ways to keep an eye on your expenses and you ought to pick one which works for you. Contemplating the present economic environment, an individual may desire to better keep tabs on personal expenses….