Asking the question how to make a debt snowball spreadsheet can be very useful when it comes to drafting up a budget and tallying up how much money you have to work with. For example, it will help you keep track of all your debts and try to stick to…

Tag: how to make a debt snowball calculator

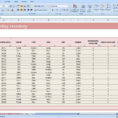

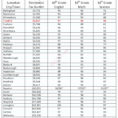

How To Create A Debt Snowball Spreadsheet

How to create a debt snowball spreadsheet? The best way is by using this formula: Cost of Debt + Interest on Debt – Monthly Payment = Effective Monthly Debt Balances. You can divide your debt into three categories: Interest on debt, cost of debt and the effective payment. Your debt…