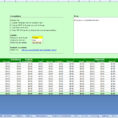

Household Budget Calculator – Keeps Track of Your Financial Situation Household budget calculator is one of the best and the easiest way to keep track of your financial situation and for you to see a realistic picture of your income and expenditures. With a simple household budget calculator you can…

Tag: Household Budget Calculator Spreadsheet

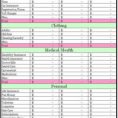

Family Budget Spreadsheet

The Importance of Family Budget Spreadsheet The Family Budget Spreadsheet Pitfall A spreadsheet is truly only a calculator, but with far more flexibility. It can improve your accuracy. Whether you use a budget spreadsheet, you probably require some manner of determining where your hard-earned money is going every month. Utilizing…