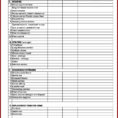

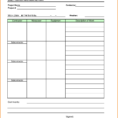

Home Office Deduction Worksheet in a learning medium may be used to test pupils talents and understanding by answering questions. Since in the Scholar Worksheet about 90% of the articles of the whole guide are questions, equally multiple decision and solution issues that are not available. While the rest consists…

Tag: home office tax deduction worksheet

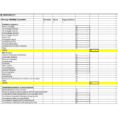

Home Office Expense Spreadsheet

The Definitive Guide to Home Office Expense Spreadsheet Get the Scoop on Home Office Expense Spreadsheet Before You’re Too Late You must regularly utilize part of your house exclusively for conducting business. In case it applies to the whole residence, you need to allocate the amount between the home office…