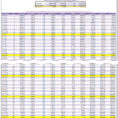

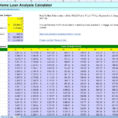

A loan comparison spreadsheet is an electronic spreadsheet that can be used to compare the different features of loans from different lenders. This is a great way to make sure you are getting the best rate on your new car loan or home mortgage loan and to avoid paying more…

Tag: Home Loan Comparison Spreadsheet

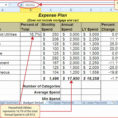

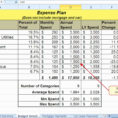

Comparison Spreadsheet Template

What You Can Do About Comparison Spreadsheet Template Starting in the Next Four Minutes The Debate Over Comparison Spreadsheet Template Cost comparison is useful not merely for domestic life but for skilled life also. It should be conducted in advance before taking any major decision. Cost comparison for a business…

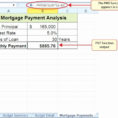

Home Loan Comparison Spreadsheet

Using a Home Loan Comparison Spreadsheet For Finding the Best Rate Home loan comparison spreadsheet can be used for finding the best rate for you and your family. Make use of a home loan comparison spreadsheet if you want to find the best deal for your monthly mortgage payments. It’s…

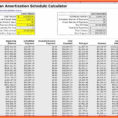

Home Loan Spreadsheet

Home Loan Sheets – Are They Necessary? Home loan paperwork is something that is very much important. Whether you are applying for a conventional mortgage or an unsecured home loan, the information on the mortgage application and the information you will provide when you make a loan application must be…