The Insider Secret on Heloc Mortgage Accelerator Spreadsheet Revealed Let’s say you receive a mortgage. You do pay your mortgage earlier should you abide by the program, saving a good deal of mortgage interest in the practice. For instance, it’s possible to argue that all of the cash flow streaming…

Tag: heloc mortgage accelerator spreadsheet

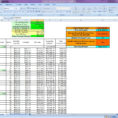

Mortgage Accelerator Spreadsheet

In the event that you want to earn your record more protected, you might also convert excel to PDF to prevent the misuse of the information from the dictionary. You might also import your present documents to Google Docs. Google Documents has a Spreadsheet attribute that also enables you to…

Heloc Spreadsheet

Know What Gurus are Saying About Heloc Spreadsheet If you prefer to use the spreadsheet, then you will have to click enable content. The spreadsheet includes several worksheets. Additionally, a downloadable… Spreadsheets might even be employed to make tournament brackets. Excel spreadsheets and Access tables enable you to customize the…