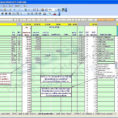

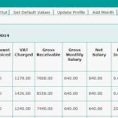

Tag: Free Vat Spreadsheet Template

Vat Spreadsheet Template

The Insider Secret on Vat Spreadsheet Template Exposed Search our blog and you may finally have different excel templates which can assist you throughout your organization operations! These templates are available on the internet and they can readily be downloaded without going through plenty of hassle. A totally free spreadsheet…

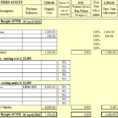

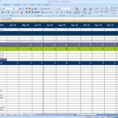

Sole Trader Accounts Spreadsheet

Want to Know More About Sole Trader Accounts Spreadsheet? Sole Trader Accounts Spreadsheet: No Longer a Mystery It’s possible to only open savings accounts created for businesses. If you require proper accounts that it is possible to submit to banks and financiers for finance, then we will need to modify…