Business Expense Sheet – 3 Best Ways To Use Expense Sheets Free business expense spreadsheet software can be very beneficial for small businesses. It can help them to find out how their company is operating and what is the present state of finances. This can be done through the following…

Tag: free small business income and expense spreadsheet

Small Business Expense And Income Spreadsheet

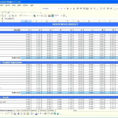

Small Business Expense and Income Spreadsheet Software If you are planning to build a financial business, you should know that there are different types of small business expense and income spreadsheet software. Some of them are great and some are just basic spreadsheet program that does not have the functionality…

Business Income And Expenses Spreadsheet

Business Income and Expenses Spreadsheet – Excel Instructions Starting a business is a wonderful thing and should be looked upon as a great thing but there are a business income and expenses spreadsheet which will be helpful for you to have. This spreadsheet will help you keep track of everything…

Small Business Income And Expenses Spreadsheet

All About An Income And Expenses Spreadsheet An income and expenses spreadsheet are a very helpful tool for those who have started out with a small business. This is especially important for the entrepreneurs who had to start it from scratch. Starting a business is no easy task. It may…

Business Income And Expense Spreadsheet

Use a Business Income and Expense Spreadsheet to Monitor Your Financial Situation The real purpose of having a business income and expense spreadsheet is to have a way to quickly find trends in your company’s income and expenses. These can be used to see how you are operating within the…