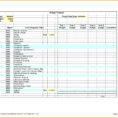

How to Use a Personal Financial Budget Template For a Simplified Budget When you first begin your budget, make sure that it is a simple and easy to understand personal financial budget template. The main idea is to make it as simple as possible so that everyone in the family…

Tag: free personal financial budget template

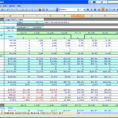

Financial Budget Template Free

What Is So Fascinating About Financial Budget Template Free? With a little bit of research, you may easily figure how much you should budget for each merchandise. Your budget is only a forecasting tool which permits you to visualize where your money goes every month. Accurately prepared budget can allow…