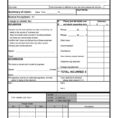

Tag: Free Income And Expense Worksheet

Spreadsheet For Tax Expenses

There are two main types of taxes: income taxes and sales taxes. Although most people tend to use the term sales tax to describe the concept of a personal income tax, there is another type of tax that is entirely separate from these two and is referred to as the…

Income And Expense Statement Template

The 30-Second Trick for Income and Expense Statement Template The statement is commonly used at the conclusion of a company period (monthly, quarterly or annually). Income statement is just one of the most crucial financial statements of a business that reveals accurate financial position of the business or company over…