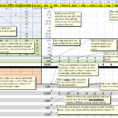

People who want to save time in calculating their finances can use a financial spreadsheet template to help them do the calculation. It is easy to do it with this. To create a financial spreadsheet template, you just need to copy and paste the information from an excel spreadsheet to…

Tag: free financial spreadsheet templates excel

Free Financial Spreadsheet Templates Excel

Free financial spreadsheet templates Excel is the best spreadsheet software used by financial professionals and businessmen. Excel is a Microsoft program that comes with many features including the capability to manipulate data, calculate charts, build reports and to add financial features such as balance sheet, profit and loss statement, etc….

Free Financial Spreadsheet

Free Financial Spreadsheet – Chooses the Best Financial Tool For You A free financial spreadsheet is one of the most valuable tools in your financial arsenal. It’s very important to be informed when looking for a spreadsheet tool. The decision to invest money into this kind of investment is difficult….