Using Free Expense Sheets Can Help Your Business A free expense sheet can be a wonderful resource for any business. It can give you good insight into the expenses that your business has incurred, and how much money you are spending on them. You should take the time to use…

Tag: free expense spreadsheet monthly

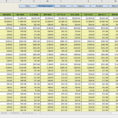

Free Financial Spreadsheet

Free Financial Spreadsheet – Chooses the Best Financial Tool For You A free financial spreadsheet is one of the most valuable tools in your financial arsenal. It’s very important to be informed when looking for a spreadsheet tool. The decision to invest money into this kind of investment is difficult….