Making a free Excel property investment analysis spreadsheet template can be done with a lot of ease. There are all kinds of business accounting software that can help you do the calculations for your company’s home and commercial real estate investments. This kind of software is designed to save time…

Tag: free excel property investment analysis spreadsheet template

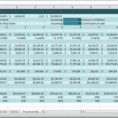

Investment Property Spreadsheet Template

An investment property spreadsheet is a template that allows you to quickly and easily create your own investment property spreadsheet. It has everything that you need to keep track of any kind of property investment, be it residential, commercial or industrial. It includes investment data including a price per square…

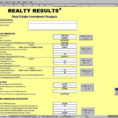

Property Investment Analysis Spreadsheet

Property investment analysis is an important tool for all investors to have on hand. Whether you are interested in real estate or a different type of investment, you need to understand the critical features that separate the good ones from the bad ones. In a nutshell, the basic property investment…

Investment Property Analysis Spreadsheet

Investment Property Analysis Spreadsheet The investment property analysis spreadsheet can help you find out all of the details about a property that you are interested in buying. As soon as you have bought it, the next thing you need to do is ensure that it is in an area that…