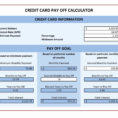

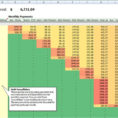

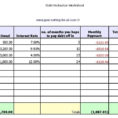

Free Debt Reduction Spreadsheet When most people think of a debt reduction spreadsheet, they think of a spreadsheet designed to help a consumer identify his unsecured debt. The reality is that the information contained in these types of programs can provide a user with additional ways to pay off his…

Tag: free debt reduction excel spreadsheet

Debt Reduction Spreadsheet Free

Debt Reduction Spreadsheet Free – The Best Way to Eliminate Your Debts Once you find a program that will help you pay off your debt, the next thing to do is to go on the internet and look for a Debt Reduction Spreadsheet Free! This would help you be able…