In the event you wish to earn your record more protected, you might also convert excel to PDF to prevent the misuse of the information in the dictionary. You might also import your present documents to Google Docs. Google Records has a Spreadsheet feature which also enables you to make…

Tag: free debt reduction calculator spreadsheet

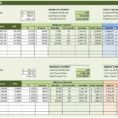

Debt Free Calculator Spreadsheet

A debt free calculator spreadsheet can be very helpful when it comes to finding the best plan to pay off your debts. This will let you know which options are right for you. You can save a lot of time by searching for a good debt free calculator. There are…

Debt Free Spreadsheet

A debt free spreadsheet can make your financial life much easier. The spreadsheet is a spreadsheet with a built in budget tool, which can keep track of your income and expenses. This tool enables you to allocate money for expenses that are important to you and to track whether your…